Summary

Global shares remain on a steady uptick at the start of 2023, a very big contrast to the beginning of 2022.

For companies across Europe, the US and the UK, many will have managed the first two months awaiting any decisions from central banks as inflation, interest rates and wider costs continue to strain business operations.

For investors, many will have heard of the phrase “Sell in May and go away”, however, could this now be the case for March?

Saxo’s Top 5 Irish Stocks to Watch

Great Western Mining Corporation

The Dublin-based mining firm struck gold, almost literally, in February after raising funds to advance their work in Nevada.

The stock grew 50% month on month with the state’s Department of Environmental Protection (NDEP) approving the work and the company given permission to “confidently move forward”. The company is expected to continue the work through the spring.

Flutter Entertainment

The owners of Betfair and Paddy Power have been in a busy period for customers off the back of a World Cup and with Cheltenham Festival, one of the UK and Ireland’s biggest horse racing events, in March.

The company’s shares have risen almost 10% in the past month. Reports in February have suggested the firm may be considering a second US listing with the territory said to be its key revenue driver with showpiece brand FanDuel contributing to this.

Engage XR

Metaverse platform designer Engage XR stock dipped on news of it announcing an almost £9million book-building share offerings at the start of February.

The company has big plans with the development of new AI “virtual” employee platform Athena. Analysts believe the product’s capabilities to learn could be an asset to all companies in the future providing client facing tasks “such as tech support, training, education, and moderation”.

Kingspan

Insulation firm Kingspan reported record profits last week with group revenue up 28%.

Share price initially rose 5% after the announcement.

The company has a number of acquisitions they’re looking to boost in pipe insulation specialist Logsto and bio-based specialist Troldtekt, both based in Denmark.

Kingspan said it expects to grow capacity for both companies by at least 50% over the next three years.

Bank of Ireland

The Bank will lay out its full year earnings on March 7th for 2022.

The company’s share price has risen 4% in the past month showing investor confidence in the stock. This could change though following the announcement.

Also, the Bank of Ireland raised interest rates on fixed-rate mortgages in January and with the ECB considering raising the base rate again in March, this could only increase further.

Diary - Company updates

March 1st - Tesla’s Investor Day

March 1st - AIB Group Annual results

March 7th - Bank of Ireland fun year results

March 7th - Greggs Full Year results

March 16th - John Lewis annual results

March 17th - St Patrick’s Day

March 21st - Nike Q3 earnings

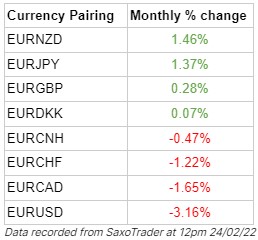

FX - Latest on the EURO

The Euro has weakened over the past month with the US Dollar strengthening.

Reports have emerged this week that the European Central Bank could raise rates again to a record high with inflation proving harder to rein in than expected, which could spell a tough period for the Euro.

Disclaimer: This should not be considered as financial, investment, tax, trading or other advice, or recommendation to invest or disinvest in a particular manner.

*Sponsored Content

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.